Even though National Cyber Security Awareness Month is just about over, that doesn’t mean it’s time to stop thinking about staying safe online.

In October, Simmons Technology identified multiple sophisticated phishing attempts to steal the personal information of College employees and students. The bad news is that this was a pretty typical month. The good news is that you can take simple steps to reduce your vulnerability to these types of attacks.

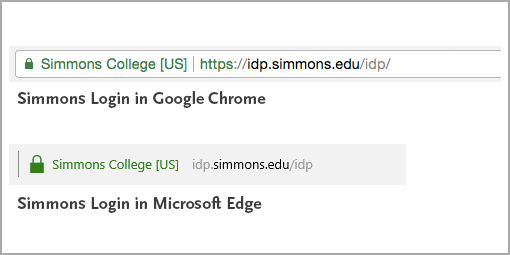

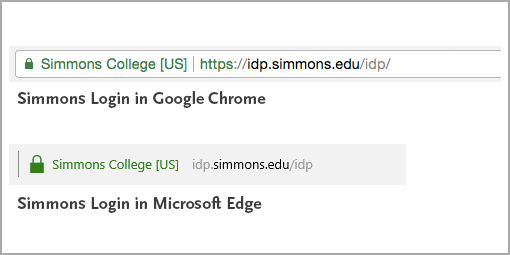

To start, always ensure that you are logging into a Simmons College website by looking for the green lock icon and the words “Simmons College [US]” in your browser’s address bar.

Most Simmons websites also use SharkPass two-step verification, which sends a push notification to your mobile device and asks you to confirm the login. If you receive a push notification but haven’t explicitly requested one from SharkPass, you should deny the login attempt.

As always, if you think your account might be compromised or that someone is trying to access your account, you can contact the Service Desk (617-521-2222) for help.

In addition to avoiding phishing attempts, you can take steps to keep your devices and data secure:

- Ensure that your computer is protected by antivirus software

- Keep your devices and apps up-to-date

- Use strong passwords and consider employing a password manager

- Never click on suspicious links or divulge personal information via email or on untrusted websites

- Stop and think before sharing content online, especially on social media

The Service Desk is available to answer your questions about cyber security and to provide you with additional resources to keep your personal information safe. Call us at 617-521-2222 or contact us online at servicedesk.simmons.edu.